To find out more in the company withholding compliance, discover Internal revenue service.gov/WHC. If the, once you found an Internal revenue service observe otherwise modification observe, your staff will provide you with an alternative finished Mode W-4 you to leads to a lot more withholding than simply manage influence under the find or amendment see, you need to keep back income tax in line with the the new Mode W-cuatro. Regular team and you can group perhaps not already performing characteristics. Occasionally, if the a serious underwithholding issue is discovered to thrive to have a type of worker, the newest Irs will get topic an excellent lock-inside the letter to the workplace specifying the newest worker’s permitted submitting reputation and you will bringing withholding recommendations on the certain worker.

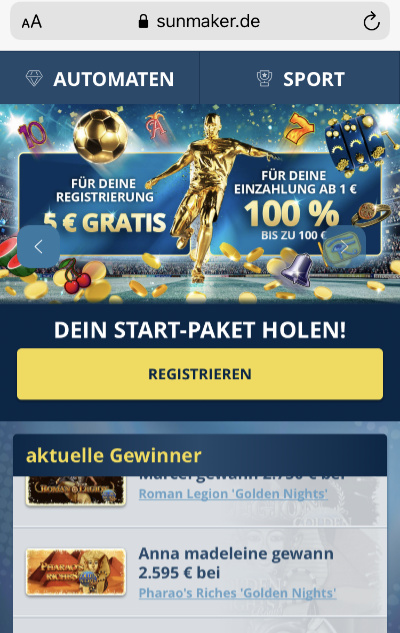

Enthusiasts may pair limited zero-put bonuses having social networking ways otherwise partner offers. Certain claims may see Fans roll-out sample campaigns with no-deposit rewards, for example $20 inside the added bonus wagers for only doing an account. When you’re Fans will not already provide a no-deposit incentive included in the national release strategy, that may changes according to local campaigns.

Doomed documentary

Red Co. said fees to your its 2024 Mode 943, range 13, from $forty-eight,000. Flower Co. are a monthly plan depositor to have 2025 because the their taxation responsibility to the cuatro house in its lookback several months (third one-fourth 2023 thanks to next one-fourth 2024) wasn’t more $fifty,000. Flower Co. advertised Form 941 taxation as follows. When you have more than 1 spend date throughout the a semiweekly months and the spend times belong various other go back periods, you’ll need to make independent deposits to the independent obligations. When you yourself have a cover date on the Wednesday, Sep 31, 2026 (3rd quarter), and something spend go out for the Friday, Oct 2, 2026 (4th one-fourth), two separate dumps will be necessary while the spend dates slip within the same semiweekly months. If you have over 1 spend date through the a semiweekly period as well as the spend schedules fall-in various other schedule household, you’ll should make independent deposits on the independent liabilities.

- Dollars earnings were checks, money requests, and you will any money or bucks.

- Including, if the total taxation in reality withheld is incorrectly claimed to the Function 941, Form 943, otherwise Form 944 due to a mathematical or transposition error, this will be an administrative mistake.

- Generally, the brand new FMV of such repayments at that time it’re also offered try susceptible to government tax withholding and you can public defense, Medicare, and you will FUTA fees.

- Better casinos on the internet give various products in order to gamble sensibly.

Yet not, a statewide judge vacation doesn’t decrease the new deadline from federal taxation places. Find part 14 to own factual statements about placing FUTA taxation. You can purchase forms, tips, and you may guides smaller on the internet. To have standard income tax information relevant to agricultural employers, see Irs.gov/AgricultureTaxCenter. Separate deposits are needed to own payroll (Setting 941, Mode 943, or Form 944) and nonpayroll (Mode 945) withholding.

Tax withholding could be thought in the same way for full-time experts or it can be thought from the area-seasons work means informed me inside section six from Pub. That it exception can be obtained as long as both the personnel and the workplace is actually members of the new sect. The usa features social security agreements, also known as totalization preparations, with many regions you to lose twin personal protection exposure and you will income tax. For more information, such as the definition of a good “film venture workplace” and you can an excellent “film investment employee,” discover section 3512.

Appeared Game

Were they within the package one of the employee’s Form W-2 (package 7 away from Setting 499R-2/W-2PR), however, don’t amount it as social security and you can Medicare wages and you can wear’t is it within the packets step 3 and you can 5 (packages 20 and you can 22 of Setting 499R-2/W-2PR). That it again increases the level of the additional taxation which you need to pay. Medicare taxation is due to your all of the earnings you have to pay Julian inside the calendar year. More resources for just what wages try subject to Medicare income tax, see section 15.

Utilize the following happy-gambler.com advice three examination to decide if or not you should spend FUTA income tax. Features made so you can a good federally recognized Indian tribal government (or any subdivision, subsidiary, otherwise team wholly belonging to for example an Indian tribe) is exempt of FUTA income tax, subject to the brand new tribe’s compliance having condition rules. FUTA income tax doesn’t connect with employers inside the American Samoa, Guam, and also the CNMI, however it does apply at employers from the USVI and you can Puerto Rico.

For 2026, Gavrielle repaid Dan $step 1,one hundred thousand inside season. Julian Silver, who had been utilized by Adam and obtained $2,100 inside the earnings before go out of buy, went on to work for your requirements. To learn more about A lot more Medicare Income tax, visit Internal revenue service.gov/ADMTfaqs. There is no workplace display of Extra Medicare Income tax. Extra Medicare Tax is only enforced to the worker.

How to Allege Enthusiasts Promos and you may Requirements?

Of several casinos in addition to use a few-basis verification or other security features to stop unauthorized entry to your bank account. They use SSL encoding to protect your own personal and you can monetary advice throughout the transactions. Knowing the conditions guarantees you can make by far the most of one’s bonuses and get away from one unexpected situations. Certain gambling enterprises render tiered loyalty techniques, with high accounts unlocking extra professionals such quicker distributions and you may personalized also provides. Secure items for each choice and you will receive her or him to possess incentives, dollars, or other rewards.

- The newest company features usage of EFTPS to ensure government income tax deposits were made for the their behalf.

- Great Five is actually an excellent 5-reel position with 50 paylines.

- The feedback shared is actually our personal, for each and every according to the genuine and you may unbiased ratings of your gambling enterprises i review.

- Find gambling enterprises having self-confident buyers analysis and you will a credibility for excellent service.

- You can even use this count to possess advice about unsolved taxation issues.

DraftKings usually launch the new $step 1,100000 added bonus within the $step 1 increments each time you bet $twenty-five on the market with -300 chance otherwise expanded. Thankfully, the new DraftKings extra framework makes you has numerous shifts from the a profitable follow-right up. Since the incentive comes in multiple portions, I recommend using this type of since the the opportunity to discuss some other betting areas. “The newest DraftKings promo is a superb place to start the new sporting events gamblers making an application for its feet damp instead of a hefty deposit.” “The capability to score $300 in the extra bets, of a small $5, presents a big well worth in the present wagering ecosystem.”

Statement the workplace share and you will worker show from public security and you may Medicare taxation to have sick spend on the Mode 941, lines 5a and you may 5c (otherwise Mode 943, traces 2 and 4; or Form 944, contours 4a and you will 4c). Which rounding happens when your shape the amount of public security and you can Medicare taxes to be withheld and you can placed from for each and every employee’s earnings. A good payer out of nonpayroll money one withheld government taxation otherwise content withholding need to file just one Mode 945 a year. Essentially, the use of a 3rd-team payer, such as an excellent PSP otherwise revealing broker, doesn’t relieve a manager of one’s obligation to make certain tax returns try registered as well as taxes is actually repaid otherwise deposited precisely and you can punctually. If you keep back otherwise must keep back federal tax (as well as backup withholding) of nonpayroll repayments, you should file Form 945. If you’re a representative with a medication Function 2678, the fresh put legislation apply to your according to the overall work taxation obtained on your part for your own group as well as on behalf of the many employers to own who you’re registered to do something.

If your employee wants to put a new Function W-cuatro on the feeling you to definitely contributes to reduced withholding than simply expected, the brand new staff have to contact the newest Internal revenue service. For those who discovered an alerts for a member of staff just who isn’t currently carrying out services for you, you’re nevertheless necessary to present the newest worker copy for the staff and you can keep back according to the observe or no of one’s pursuing the implement. The newest decelerate between your bill of the find as well as the day to start the brand new withholding using the see it permits the newest worker time to get in touch with the fresh Irs.

Social protection and you can Medicare taxes perform connect with repayments made to a daddy to have domestic features if the all the pursuing the apply. Domestic features susceptible to personal defense and Medicare taxes. Payments to your functions out of a kid lower than many years 18 which works for the mother or father inside the a trade or business aren’t subject to societal defense and you will Medicare taxation if your change or organization is an only proprietorship or a collaboration where for each spouse are a pops of one’s boy.